On June 19, 2023, Dr. Liu Du, Research Director of Shenzhen Angel FoF Management Co., Ltd., walked into the classroom of Principals of Economics of Business School and had an in-depth communication with Financial Management students of 2022 cohort on angel investing and the working experience of the private equity investment industry.

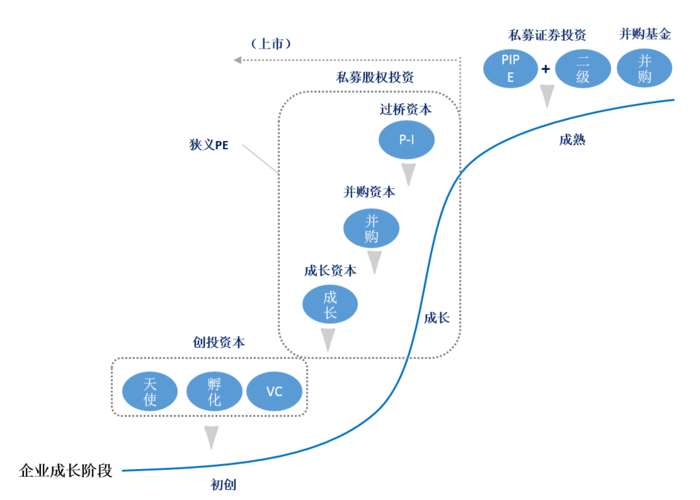

Professional terms such as VC, PE, and angel investment sound fancy, but their meanings are confusing to most people. In fact, VC is short for Venture Capital, and PE is short for Private Equity. From a broad definition, PE includes VC, but from a practical point of view, the difference between the two mainly lies in the different life cycles of the investment objects, VC mainly invests in the start-up stage of the enterprise, while angel investment is the earliest direct equity investment in VC; PE mainly invests in the growth and Pre-IPO stages. They are all equity investments, and the fund is raised privately. Therefore, whether it is angel investment, VC or PE, its operation process is divided into four main stages of "fundraising", "investment", "management" and "withdrawal", once the invested company is successfully listed, the fund may enjoy extremely high investment returns, but because the proportion of IPO exit is extremely low, the risk is much higher than other types of investment.

The nature of venture capital determines that it is extremely important in supporting and leading a country's scientific and technological innovation and industrial strategy. Since around 2002, China began to explore using government guidance fund to support the development of key industries. Answering to that call, Shenzhen Angel FoF is a strategic and policy fund invested and initiated by the Shenzhen Government, which is a policy measure for Shenzhen to benchmark against the top operations of the world, make up for the shortcomings of venture capital, and help the development of seed-stage and start-up enterprises. Shenzhen Angel FoF is funded by Shenzhen Guidance Fund, which is the largest angel investment government guidance fund in China with a current scale of 10 billion yuan. The fund focuses on investing in angel projects that cultivate strategic emerging industries and future industries, and cooperates with well-known investment institutions such as Shenzhen Capital Group, Lenovo Capital, CDH investment, China Resources Capital, etc. It provides strong support for Shenzhen to build an international venture capital center as well as an industrial innovation center.

Venture capital is relatively mysterious in the investment industry, and the investment stories of Masayoshi Son from the SoftBank Group, Xu Xiaoping from the Zhen Fund, Shen Nanpeng from Sequoia China and others have cast a legendary veil over the industry. This lecture introduced the basic structure of the venture capital industry in China, the main business of Shenzhen angel FoF, as well as the working experience of the private equity investment industry and the basic requirements for professional knowledge and ability of related positions, and provided vivid cases for the application of economic knowledge in practical work.

Picture/Text: Kailey Yahui ZHANG